Monday Okpebholo, the Edo State Governor, has approved the appointment of Tony Kabaka, a confessed cultist who claims to have repented from political thuggery, as an enforcement consultant for the state’s internal revenue service.

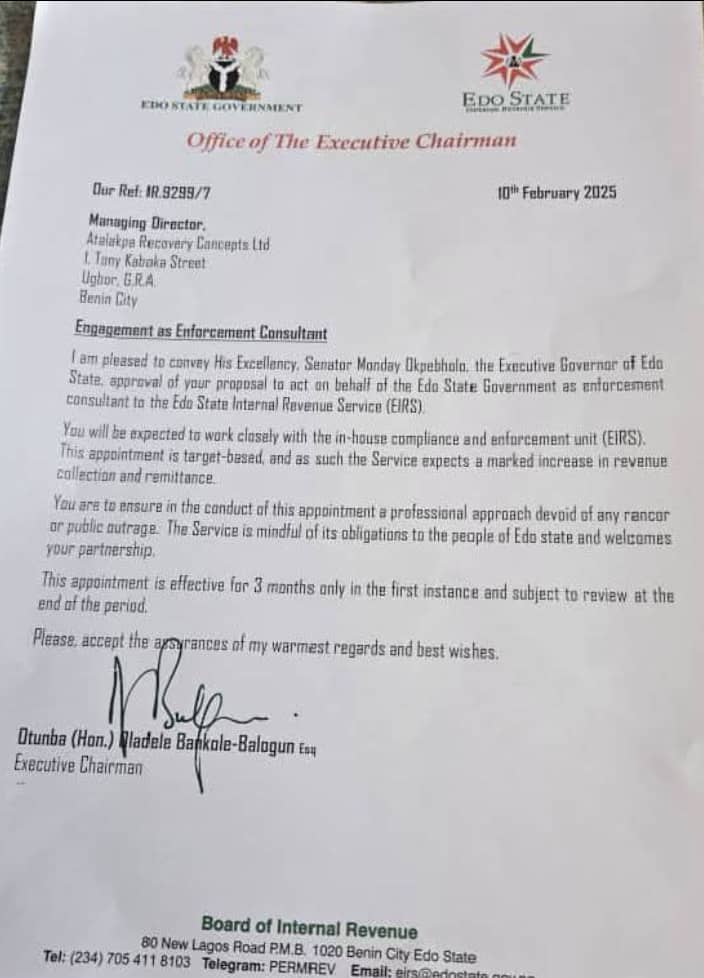

Via a letter dated February 10, and addressed to Kabaka, the managing director of Atalakpa Recovery Concepts Ltd., the Edo State Internal Revenue Service (EIRS) said he will “work closely with the in-house compliance and enforcement unit” to help increase revenue collection and remittance.

The contract says his company’s engagement would be for an initial three-month period, within which the state expects a significant revenue rise.

Oladele Bankole-Balogun, the Executive Chairman of EIRS, signed the letter.

The letter read in part, “I am pleased to convey His Excellency, Senator Monday Okpebholo, the Executive Governor of Edo State, approval of your proposal to act on behalf of the Edo State Government as enforcement consultant to the Edo State Internal Revenue Service (EIRS).

“You will be expected to work closely with the in-house compliance and enforcement unit (EIRS). This appointment is target-based, and as such the Service expects a marked increase in revenue collection and remittance.

“You are to ensure in the conduct of this appointment a professional approach devoid of any rancour or public outrage. The Service is mindful of its obligations to the people of Edo State and welcomes your partnership.

“The appointment is effective for three months only in the first instance and subject to review at the end of the period.”

THE COMPANY

FIJ looked into Atalakpa Recovery Concepts Ltd., the company handed the contract, and found that it was inactive on the Corporate Affairs Commission (CAC) website.

According to the CAC’s frequently asked questions page, “If your business status is inactive on (the) CAC website, you will need to file your annual returns up to date before the status of the business can become active. Some people usually ask, why is my business status still inactive after filing the annual return? After filing your annual returns, you will need to send a mail to the Corporate Affairs Commission and request that they should change your business status from ‘inactive’ to ‘active’. You should attach the acknowledgement letter of approval for your annual return to the mail.”

The page also states that if a company’s status is inactive, then it has not filed its annual returns. Filing takes three to seven days on average.

By awarding a contract to this company, the EIRS has violated the Companies and Allied Matters Act (CAMA). Awarding a contract to a company that is deemed not to be operational is illegal.

According to the CAMA, companies that repeatedly fail to file annual returns may face delisting from the CAC database. If they fail to file for a period of 10 years, their name will be struck out of the companies’ register losing their legal status and privileges S. 425 (3) CAMA, 2020.

For a Limited Liability Company like Atalakpa, CAMA says they must submit their annual filings no later than 42 days after their annual general meeting.

On Friday, FIJ called Kabaka to ask about this development. He said, “I registered on CAC. I have all the documents”, but when asked if he was familiar with CAMA, Kabaka handed the phone to a man he described as his personal assistant.

This personal assistant said he knew the company completed its registration in 2016, but he was not aware of CAMA or annual returns commitment.

“We are active,” he told FIJ.

“We even have a contract with the railway corporation. Please send me the details for what we have to do, and I will send it to the company account officer.”

KABAKA

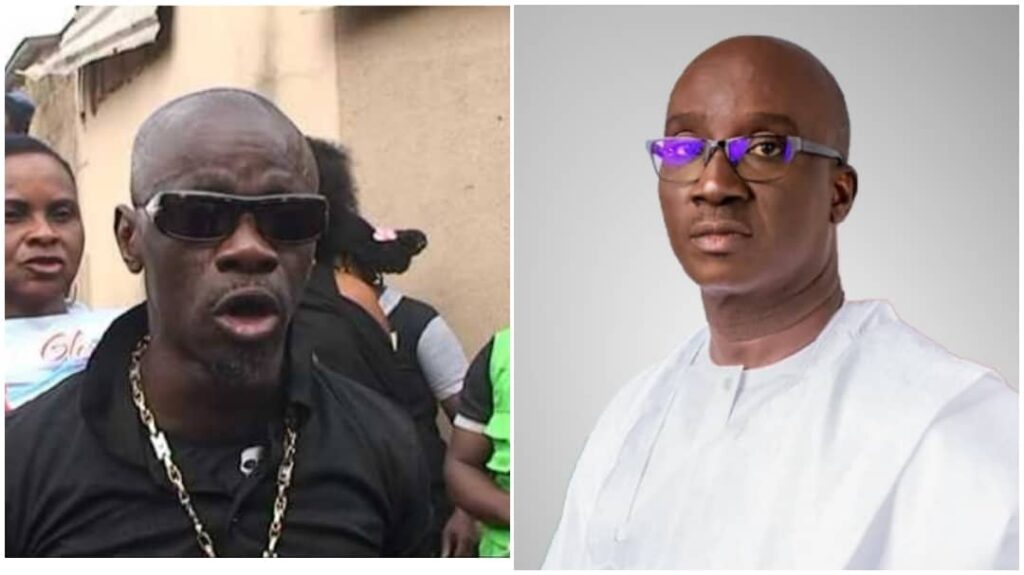

In 2021, Kabaka confessed to the BBC that he was involved in cultism and played an active role in the Edo State Government for years until 2019.

He also said he was asked to mobilise cult groups to help win elections.

Via his company, Akugbe Ventures, Kabaka claimed he employed over 7,000 tax collectors and helped generate billions of naira for the state.

“If you sat me down and say, ‘Can you identify Black Axe in government?’ I will identify,” he told the BBC.

“Most politicians, almost everybody is involved.

“If the government wants to seek for election they need them. Cultism still exists because government is involved, and that is the truth.”

FIJ earlier reported how Kabaka and others caused a ruckus outside the Edo State High Court in Benin prior to the relocation of the governorship election tribunal to Abuja.