An increasing number of importers, evading multiple and soaring taxation across Nigerian ports, are heading to neighbouring West African countries, especially Togo, Ghana and Benin, to remain in business.

The charges, imposed by multiple government agencies, terminal operators and shipping companies have increased by almost 100 per cent in less than a month, raising cargo clearance above the reach of most operators.

Coming amidst huge haulage costs, The Guardian gathered that Lagos ports now record a significant decline, a development which is making a mess of Nigeria’s ease of doing business campaign.

The Nigerian Ports Authority (NPA) recently increased all port rates, dues and tariffs from seven per cent to 15 per cent, amounting to over 100 per cent hike.

Until it suspended the implementation of the proposed charge, the Nigeria Customs Service (NCS) had imposed a four per cent charge on the free-on-board (FOB) value of imported goods, in addition to the existing one per cent Comprehensive Import Supervision Scheme (CISS) fee.

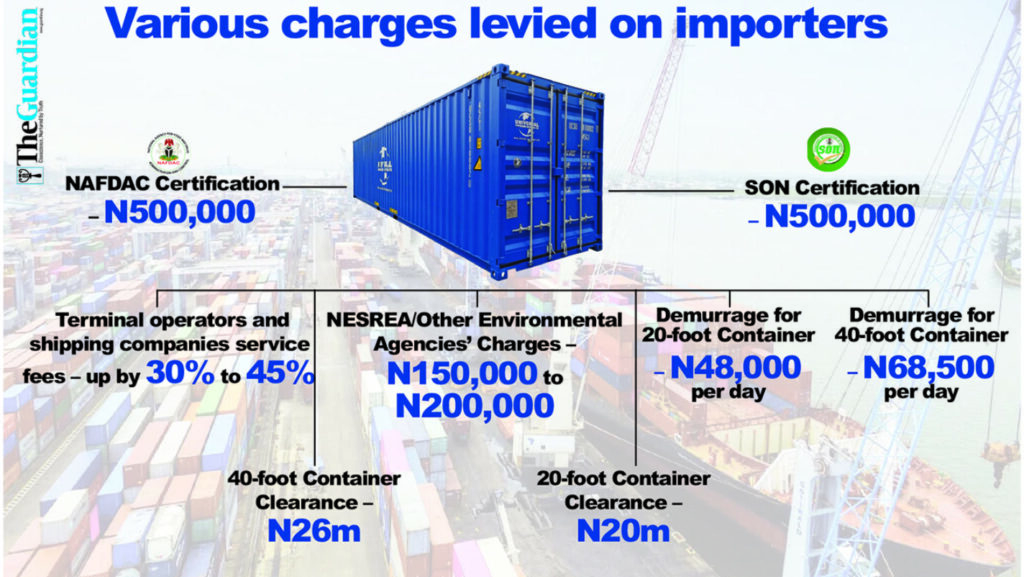

Already, terminal operators and shipping companies have increased their different fees from 15 to between 20 per cent to 45 per cent, depending on the operator.

Other government agency charges are also being considered for upward review, according to findings. These include N500,000 importers pay for the Standards Organisation of Nigeria (SON) and the National Agency for Food and Drug Administration and Control (NAFDAC) certifications.

The National Environmental Standards and Regulations Enforcement Agency (NESREA) and other environmental agencies at the ports charge between N150,000 and N200,000, which may also see an upward review.

Unofficial payments, such as tips to fast-track clearance, range from N10,000 to N20,000 per spot. With the introduction of the new four per cent levy, industries importing raw materials, where duties are typically five per cent now cough out an additional 80 per cent of the duty amount in administrative fees imposed by the customs agency.

As a result, clearing costs have surged. The total cost of a 40-foot container has risen from N18 million and N20 million to N26 million since the end of January, while the cost of clearing a 20-foot container has almost doubled – from an average of N10.5 million to N20 million.

Once a dominant hub for 70 per cent of West African-bound cargo, Nigerian ports are losing their trade advantage as importers explore facilities in Ghana, Togo and the Benin Republic.

The Managing Director of the NPA, Dr Abubakar Dantsoho, Nigeria handles less than two million TEUs even though 70 per cent of the cargoes coming to the region is headed to Nigeria. The rest are routed through Togo, Benin and others.

The Shippers Association of Lagos (SAL) also noted that most of its members route their containers through other West African ports from where they are hauled into the country.

Nigeria’s economic climate is already strained by rising inflation, foreign exchange volatility, and declining industrial capacity utilisation as many businesses are struggling with unsustainable operating costs, soaring energy prices and general economic uncertainty.

At the ports, multiple government agencies, alongside terminal operators and shipping firms, have implemented higher charges without corresponding improvements in infrastructure or service quality.

The Minister of Marine and Blue Economy, Adegboyega Oyetola, recently acknowledged that the cost of doing business at Nigerian ports is 40 per cent higher than it is in other West African countries, making them more competitive.

The business community, including shippers, manufacturers, importers and customs agents, is grappling with numerous financial burdens.The Chief Executive Officer of Globe Joy Investment Nigeria Limited, Clinton Ikechukwu Okoro, expressed concern over the tariff hike, stating that the benchmark for import charges has risen from N14 million to between N17 million and N18 million for importers.

He explained that by the time all fees and levies are factored in, the cost of clearing a 40-foot container will reach N26 million, while a 20-foot container will now cost N20 million.

Okoro, who also serves as the Public Relations Officer of the Africa Association of Professional Freight Forwarders and Logistics of Nigeria (APFFLON), Tin Can Chapter, warned that these escalating costs are making it increasingly difficult for importers to operate, ultimately shifting the financial burden to consumers.

Beyond the agencies’ financial strain, excessive delays, demurrage fees and storage charges continued to frustrate importers. Despite possessing all required certifications, many importers experience clearance hold-ups imposed by regulatory agencies, extending between two to seven days and incurring additional costs.

A breakdown of daily charges reveals that demurrage fees stand at N68,500 per day for a 40-foot container and N48,000 for a 20-foot container.

Meanwhile, storage fees, previously ranging from N6,000 to N12,000 per day, have now nearly equalled demurrage rates. Okoro further stated that even after meeting all requirements, importers still face unnecessary delays, noting that while they wait, demurrage and storage costs continue to accumulate.

A former President of the SAL, Jonathan Nicol, echoed these concerns, revealing that 60 per cent of cargo meant for Nigeria is now being diverted to neighbouring ports due to high costs and bureaucratic hurdles that hinder the ease of doing business.

He cited data from the shipping association, indicating that Nigerian shippers bear more yearly in non-customs-related fees, making trade increasingly unsustainable.

“We need the government to reduce the cost of doing business. Shippers already struggle with levies from shipping companies, terminal operators, and clearing agents. If additional costs are imposed, the situation will worsen,” Nicol stated.

Providing evidence of the escalating costs, he shared a receipt from a recently cleared cargo, detailing an import duty payment of N11.2 million, an ECOWAS Trade Liberalisation Scheme (ETLS) fee of N280,449, a Financing NCS Operations (FCS) charge of N1,857,756, a Comprehensive Import Supervision Scheme (CISS) fee of N464,440 and a surcharge of N785,253.

A key stakeholder in Nigeria’s maritime sector, Funmilayo Uche, warned that rising charges and inefficiencies are pushing importers away. “In December, we moved a 40-foot container for N400,000 to N500,000. Today, it costs between N850,000 and N1 million. How can businesses survive?” she asked.

Uche criticised the justification for these price hikes, particularly the Nigerian Ports Authority’s (NPA) claim that fees had remained unchanged for 32 years.

“They say they need funds for infrastructure, but where are the improvements? Even simple processes like obtaining loading papers are chaotic. Truckers blame the NPA, the NPA blames terminal operators, and terminal operators claim they’re not responsible. It is a mess,” she said.

She warned that Nigeria’s ports could lose their competitive edge entirely, as major importers are now shifting cargo to neighbouring countries due to the rigidity of Nigeria’s system.

According to her, the solution isn’t endless fee increases. “If a hike is necessary, why not five per cent instead of 15 per cent? What value is the business community getting in return?” she questioned.

The Director General of the Manufacturers Association of Nigeria (MAN), Segun Ajayi-Kadir, cited a United Nations Conference on Trade and Development (UNCTAD) report, which found that 80 per cent of Nigeria’s trade is transported by sea, with 70 per cent of total West and Central African imports and exports destined for Nigeria.

He emphasised that for manufacturers, port-related charges represent significant indirect costs, as most raw materials and industrial machinery are imported through these ports.

Ajayi-Kadir warned that any further charges would ripple across the economy, leading to higher production costs, inflation and reduced competitiveness of locally manufactured goods.

“Failure to address these concerns will drive more businesses away, resulting in significant revenue losses, job cuts, and deeper economic hardship,” he cautioned.